What Does $255 Payday Loans Online Same Day Do?

Wiki Article

The Facts About $255 Payday Loans Online Same Day Revealed

Table of ContentsThe 10-Second Trick For $255 Payday Loans Online Same DayThe Buzz on $255 Payday Loans Online Same DayThe 8-Minute Rule for $255 Payday Loans Online Same DayHow $255 Payday Loans Online Same Day can Save You Time, Stress, and Money.The Best Guide To $255 Payday Loans Online Same DayThe smart Trick of $255 Payday Loans Online Same Day That Nobody is Discussing

The car loans are for little amounts, and also numerous states established a restriction on cash advance dimension. $500 is an usual lending limitation although limitations range above as well as listed below this amount. A payday advance is generally paid off in a single repayment on the debtor's following payday, or when revenue is obtained from an additional resource such as a pension plan or Social Safety and security.

The specific due date is established in the payday lending agreement. If you don't settle the financing on or before the due day, the lender can cash the check or online take out cash from your account.

The loan proceeds might be supplied to you by cash money or check, online deposited into your account, or filled on a pre paid debit card. Various other loan features can differ. For example, cash advance are often structured to be settled in one lump-sum settlement. Some state regulations allow lenders to "rollover" or "restore" a financing when it ends up being due to make sure that the consumer pays just the charges due and also the lending institution expands the due day of the funding.

The $255 Payday Loans Online Same Day Ideas

Several state laws set an optimum amount for cash advance funding costs varying from $10 to $30 for every $100 obtained. By comparison, APRs on credit score cards can range from concerning 12 percent to concerning 30 percent.

Some states do not have cash advance financing due to the fact that these finances are not allowed by the state's law or because payday loan providers have actually chosen not do to organization at the rates of interest and also fees allowed in those states. In states that do permit or regulate payday loaning, you might have the ability to find even more details from your state regulatory authority or state chief law officer .

Those protections consist of a cap of 36 percent on the Military Interest Rate (MAPR) as well as other constraints on what lending institutions can bill for cash advance as well as various other customer financings. Contact your neighborhood Judge Supporter General's (BUZZ) office to get more information concerning lending restrictions. You can utilize the buzz Legal Aid Office locator to discover assistance.

The Ultimate Guide To $255 Payday Loans Online Same Day

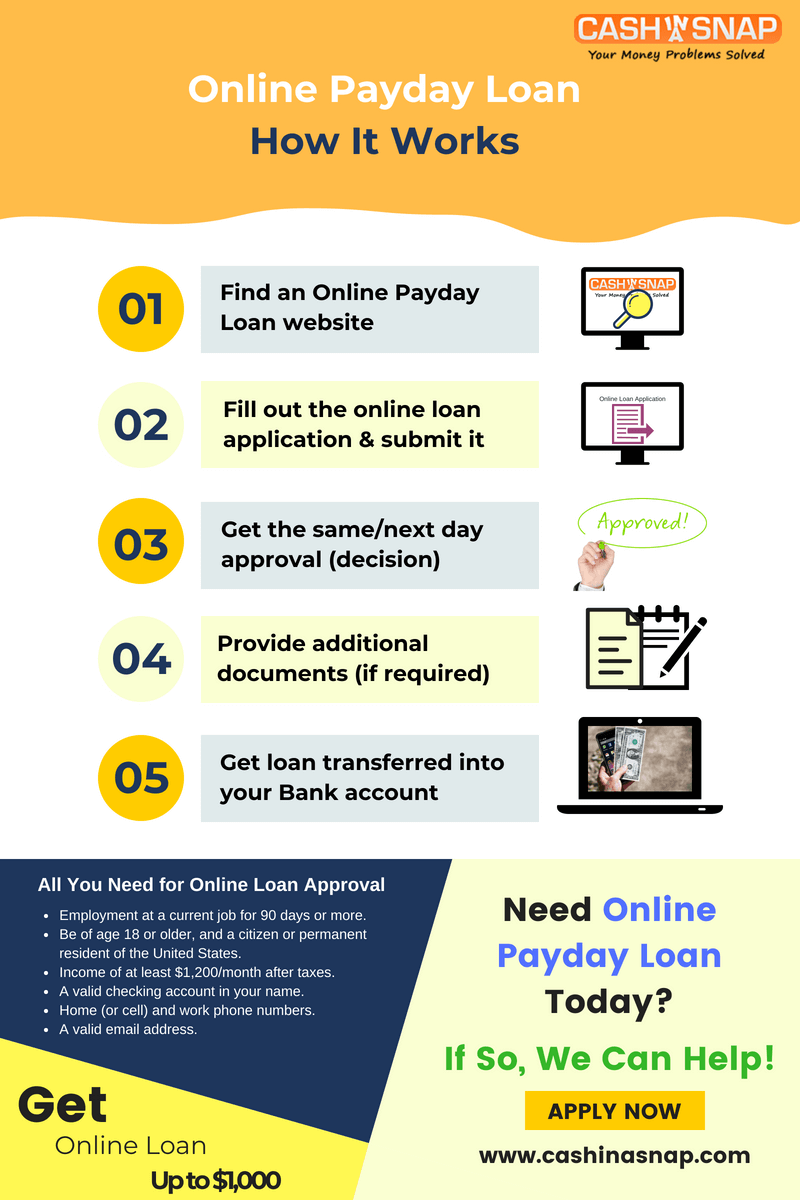

A payday advance loan is a short-term check these guys out funding that can aid you cover immediate cash money needs up until you obtain your next income. These small-dollar, high-cost financings typically bill triple-digit yearly portion rates (APRs), as well as settlements are typically due within 2 weeksor near to your next payday. Cash advance are not for the faint of heart.Prior to you obtain one, it is very important to understand what you'll get and also what's anticipated from you in return. Payday advance loan work in different ways than individual and other customer loans. Depending upon where you live, you can obtain a payday advance my review here online or with a physical branch with a payday lender.

Some states restrict payday finances altogether. When you're accepted for a cash advance finance, you may receive cash or a check, or have actually the money deposited into your savings account. You'll then require to pay back the finance in full plus the financing fee by its due day, which is usually within 2 week or by your next paycheck.

The 7-Minute Rule for $255 Payday Loans Online Same Day

Since payday finances have such brief settlement terms, these expenses equate to a high APR. According to the Customer Federation of America, cash advance APRs are typically 400% or even more. Despite the high expenses, The Economic expert price quotes that about 2. 5 million American households take out payday advance loan yearly.

One is that many people that resort to payday financings don't have other funding options. Some individuals might not be comfortable asking household members or buddies for support.

Lots of people resort to payday look at here now lendings since they're easy to get. The majority of don't run a credit history check or even require that the borrower has the methods to settle the finance.

7 Easy Facts About $255 Payday Loans Online Same Day Described

The typical cash advance is $350 on a two-week term, according to the CFPB. Payday finances can range from $50 to $1,000, depending on your state's laws. Currently, 32 states permit cash advance financing with a capped optimum car loan amount. Maine, Utah, Wisconsin and Wyoming do not have a cap.Some states, including Nevada as well as New Mexico, additionally limit each cash advance to 25% of the consumer's regular monthly income. For the 32 states that do allow payday loaning, the cost of the finance, charges and the optimum loan amount are capped.: 37 states have details laws that permit for payday borrowing.

Arizona and also North Carolina allowed pre-existing cash advance lending laws to sunset. Arkansas rescinded its pre-existing law in 2011. New Mexico rescinded its cash advance lending laws in 2017. The District of Columbia reversed its pre-existing legal arrangement in 2007. The expenses connected with payday advance loan are established by state laws with charges varying from $10 to $30 for every single $100 borrowed.

How $255 Payday Loans Online Same Day can Save You Time, Stress, and Money.

For instance, allow's state you borrow $100 for a two-week cash advance and also your lending institution is charging you a $15 fee for every single $100 borrowed. That is a straightforward rate of interest of 15%. Given that you have to repay the funding in 2 weeks, that 15% financing cost equates to an APR of almost 400% due to the fact that the financing length is just 14 days.

Report this wiki page